|

Background The primary objective of this Statement is to amend GASB Statement No. 62 to enhance accounting and financial reporting requirements for accounting changes and error corrections in order to provide more understandable, reliable, relevant, consistent, and comparable information for making decisions or assessing accountability. In a recent news release, GASB Chair Joel Black stated that “governments and other stakeholders should find many of the requirements of Statement 100 familiar. But they should find the understandability of the guidance greatly improved, and financial statement users should benefit from the new tabular disclosure.” What’s Covered? There are four main items covered by GASB Statement No. 100: Changes in Accounting Principle

Changes in Accounting Estimates

Changes to or within the Financial Reporting Entity

Corrections of errors

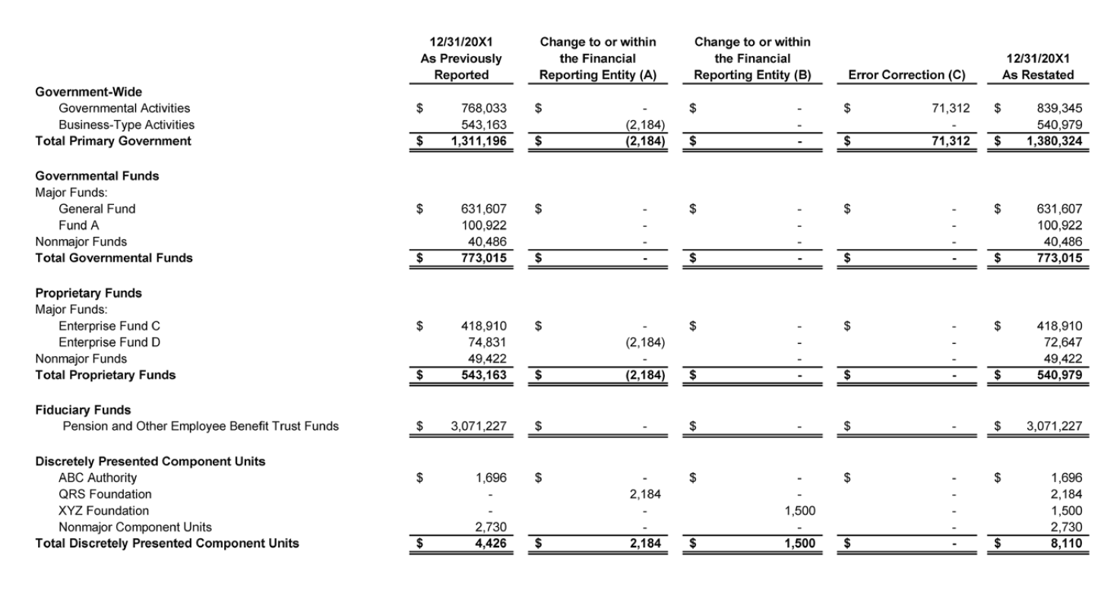

What’s the Impact? For financial statements that present a single period, changes in accounting principle should be reported retroactively by restating beginning net position, fund balance, or fund net position, as applicable, for the cumulative effect, if any, of the change to the newly adopted accounting principle on prior periods. If practicable to do so, for comparative financial statements, changes in accounting principle should be applied retroactively by restating the earliest period presented. If this is not practicable, changes in accounting principle should be reported retroactively by restating the beginning net position, fund balance, or fund net position, as applicable, of the earliest period for which it is practicable to apply the newly adopted accounting principle. Changes in accounting estimates should be reported prospectively by recognizing the change in accounting estimate in the reporting period in which the change occurs. Changes to or within the financial reporting entity should be reported by adjusting the current reporting period’s beginning net position, fund balance, or fund net position, as applicable, for the effect of the change as if the change occurred as of the beginning of the reporting period. For financial statements that present a single period, error corrections should be reported retroactively by restating beginning net position, fund balance, and fund net position, as applicable, for the cumulative effect of the error correction on prior periods. For comparative financial statements, error corrections should be reported retroactively by restating financial statements for all prior periods presented. The cumulative effect of the error correction on periods prior to those presented should be reported as a restatement of beginning net position, fund balance, or fund net position, as applicable, of the earliest period presented. Each individual prior period presented should be restated to reflect the period specific effects of correcting the error. The standard includes an example tabular presentation, which we have included here: |

|

|

Impact on RSI and SI GASB Statement No. 100 also addresses how required supplementary information (RSI) and supplementary information (SI) that accompanies government financial statements should be changed. For changes in accounting principle and changes to or within the financial reporting entity, RSI or SI that presents information that is earlier than the information presented in the basic financial statements should NOT be restated. For example, in fiscal year 2022 financial statements that present a single year, any RSI or SI covering fiscal year 2021 or earlier should not be restated for changes in accounting principle or changes to or within the financial reporting entity. For error corrections, however, any RSI or SI that is affected by an error should be corrected and restated, if practicable to do so. In addition, information in RSI or SI should be identified as restated or corrected with an explanation about the nature of the error, as applicable. Final Thoughts The biggest change in GASB Statement No. 100 from previous standards involves the new disclosure requirements for additions, removals, and changes in presentation of funds; and additions, removals, and changes in presentation of component units. However, all four items presented in GASB Statement No. 100 could result in significant changes to the financial statements if they are applicable to the financial reporting entity. GASB Statement No. 100 provides guidance on related note disclosures, as well as sample disclosure narratives and tables. If additional guidance is needed, please feel free to reach out to any of the Mauldin & Jenkins professionals in our Governmental Practice. |