By: Rob Douglas, CPA

Ever since the Tax Cuts and Jobs Act capped the individual deduction for state and local taxes at $10,000, state lawmakers have been under pressure from their constituents to offer a solution. Georgia is one of numerous states in the Southeast, and across the nation, to adopt legislation that offers a SALT cap workaround.

Signed by Governor Kemp in May 2021, Georgia’s SALT Parity Act (House Bill 149) allows certain partnerships and S corporations to elect to pay state income taxes at the entity level for tax years beginning on or after January 1, 2022. S corporations and partnerships that are 100% directly owned by persons eligible to be shareholders of an S corporation under IRC 1361 are eligible to make the election. The election must be made annually by the due date of the corporate or partnership return, including extensions, and is irrevocable once made.

Georgia’s SALT Parity Act specifies that choosing to be taxed at the entity level requires the entity to receive consent from owners to make the annual election. The proposed regulations indicate that it is up to each electing pass-through entity to decide how to obtain consent from its owners. Once the election is made, it is binding on all of the owners. If the business is eligible to make the election and receives owner consent, the entity pays a 5.75% state tax rate on taxable income for the year and can then deduct the state taxes paid on the federal income tax return, with no limit. The owner’s K-1 for Georgia would report no income allocable to the state. This change effectively circumvents the TCJA’s SALT cap for eligible taxpayers by reclassifying individual earnings as business earnings.

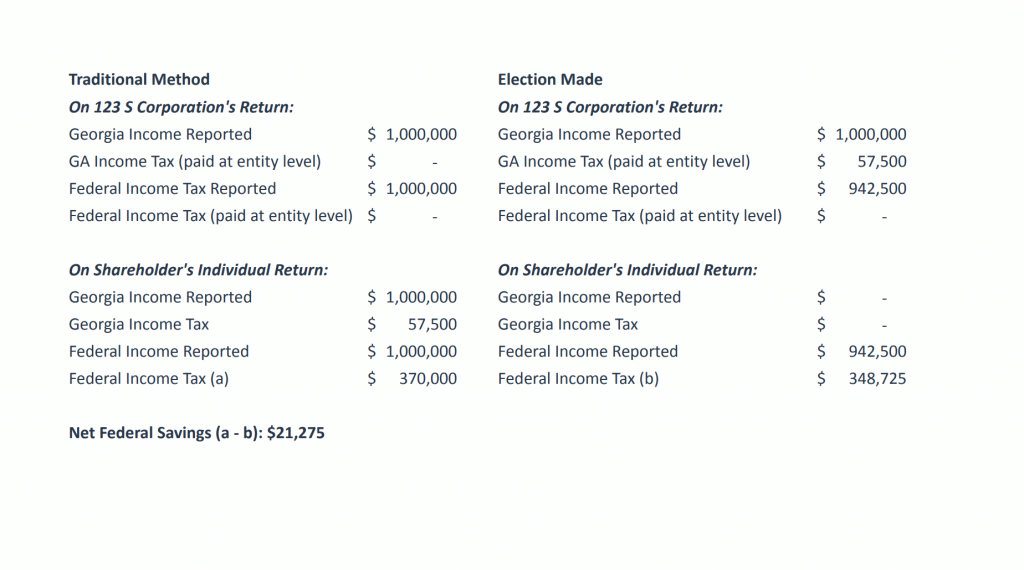

Example:

123 S corporation, a single-member LLC, with $1,000,000 in taxable income:

Getting consent from all owners may prove to be a challenge. By making this election, the owners lose the ability to receive a credit for taxes paid to other states. The lack of credit on the individual income tax return for other state taxes paid eliminates reciprocity, meaning the Georgia resident owners benefit at the expense of non-Georgia resident owners. Pass-through entities with owners in multiple states must carefully consider the tax consequences before electing to pay state tax at the entity level.

Nearby states, including Alabama and South Carolina, have passed similar legislation to allow a SALT cap workaround. Other states continue to explore their options to provide similar benefits.

On October 27, 2021, the Georgia Department of Revenue issued proposed regulations on the election to pay tax at the passthrough entity level with a comment period ending November 29, 2021. Eligible owners will be better able to gauge the potential impacts of making the election once these regulations are finalized and forms and instructions available for review.

Owners of passthrough businesses should closely monitor the evolving tax landscape as it relates to SALT limit workarounds, as the potential impact on overall tax liability can be significant. Contact a Mauldin & Jenkins advisor to get the latest updates on your state and to determine the most beneficial course of action in your tax situation.