Selling or buying a business is complicated. You need the right advisor who has real-world experience to guide you in every step of a transaction, with a client-centric focus along the way. Whether you’re a potential investor, capital provider, or business executive, we’re here to help.

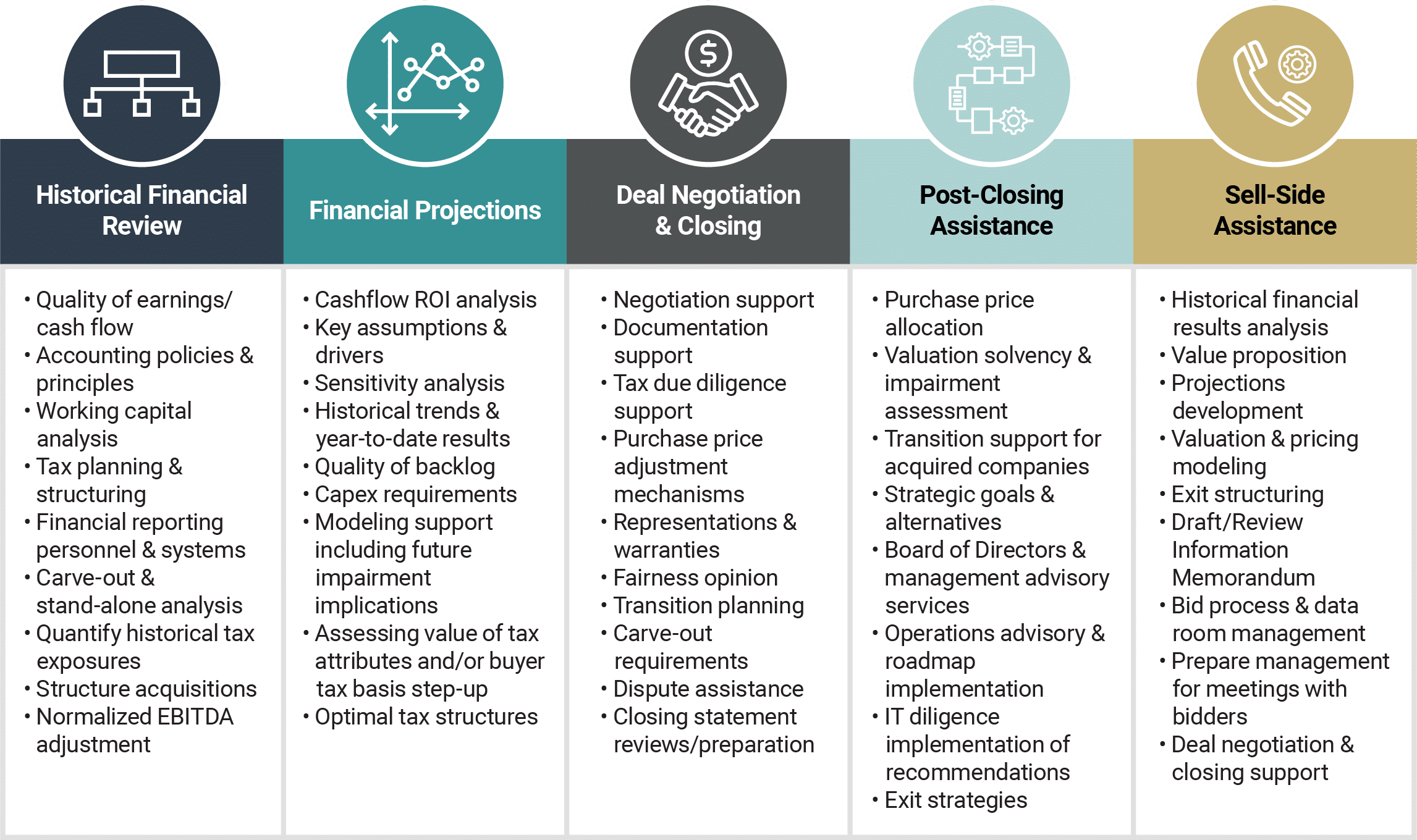

Our transaction advisory services are designed to match each client’s unique situation, and you can be confident that you’ll receive expert analysis and precise data at every stage of a deal. Our due diligence and valuation services ensure you’ll be fully informed and prepared to make investment decisions with the utmost confidence.

Strategic Acquirers

Capital Providers

Financial Investors

From the initial arrangement and evaluation of a proposed transaction through closing and beyond, our experienced team will ensure you identify risk, minimize tax exposure, and maximize value creation. Our multi-disciplinary approach combines industry expertise, fundamental financial competency, accounting, and tax expertise to assess key deal drivers. We provide our clients with all of the information necessary to make informed business decisions throughout the transaction lifecycle.

Our multi-disciplinary approach ensures that you’ll be abreast of the risks and opportunities involved in a transaction. We’ll also help you understand the pros and cons of each choice made during the entire transaction lifecycle, and our innovative solutions will ensure you’re making the right decision for your individual circumstances.

Our experience spans both the buy and sell side of transactions, and we can even assist once the deal has been long closed; our post-transaction integration services ensure that the financial optimization doesn’t end once the papers are signed. Contact us to learn more about our transaction advisory services and how we can help you.

Transaction advisory services include:

Historical Financial Review

Quality of Earnings (QOE) Reporting

Identification and adjustment for accounting irregularities and other factors that may distort a transaction's true earnings picture. Develop a clear understanding of a target’s sustainable earnings power and financial health.

Working capital analysis

Deliver actionable insights to optimize liquidity, streamline operations, and maximize profitability to determine a business’s sustainable business growth.

Normalized EBITDA adjustments

Develop a transparent and accurate picture of a company's core operating performance, making it easier for investors, stakeholders, and decision-makers to evaluate a target’s financial health and potential.

Financial Projections

Cashflow and ROI analysis

Insight into the profitability and financial performance of an investment opportunity to assess the risks and opportunities associated with a transaction.

Review long-term forecasts, key assumptions, and deal drivers

Evaluate how projections bridge to actual historical results to determine the reasonableness of key assumptions.

Optimal tax structure analysis

Evaluate the accuracy and completeness of tax-related information, uncover any potential liabilities or issues, and provide recommendations for optimizing the tax structure to achieve the most favorable outcomes.

Deal Negotiation & Closing

Purchase agreement review

Confirm that purchase agreements align with a client’s strategic objectives, identify potential risks or inconsistencies in agreements, and recommend adjustments to the transaction terms when applicable.

Deal analysis and purchase price adjustments

Establish recommendations to optimize deal structure, negotiate terms, mitigate risks, and maximize value.

Negotiation Support and dispute assistance

We also provide dispute assistance, guiding negotiations and resolving contentious issues related to transaction terms, purchase price adjustments, and pricing disagreements.

Review and preparation of closing statements

Ensure the accuracy of closing documents, compliance with accounting and regulatory requirements, and clarity regarding the financial aspects of a deal. Meticulous analysis ensures a smooth and successful transition for all parties involved.

post close

Valuation, solvency, and fairness opinions, and post-close support

Utilize valuation and industry expertise along with proprietary databases to support purchase price allocations and post-close initiatives.

Integration, Operations advisory, and implementation of strategic initiatives

Develop recommendations for efficient integration of newly acquired businesses, assistance implementing strategic initiatives, or and support divesting assets or operations.

Exit strategies

Learn the most effective ways to exit a business, whether through a sale, merger, or other method, while maximizing stakeholders' value.