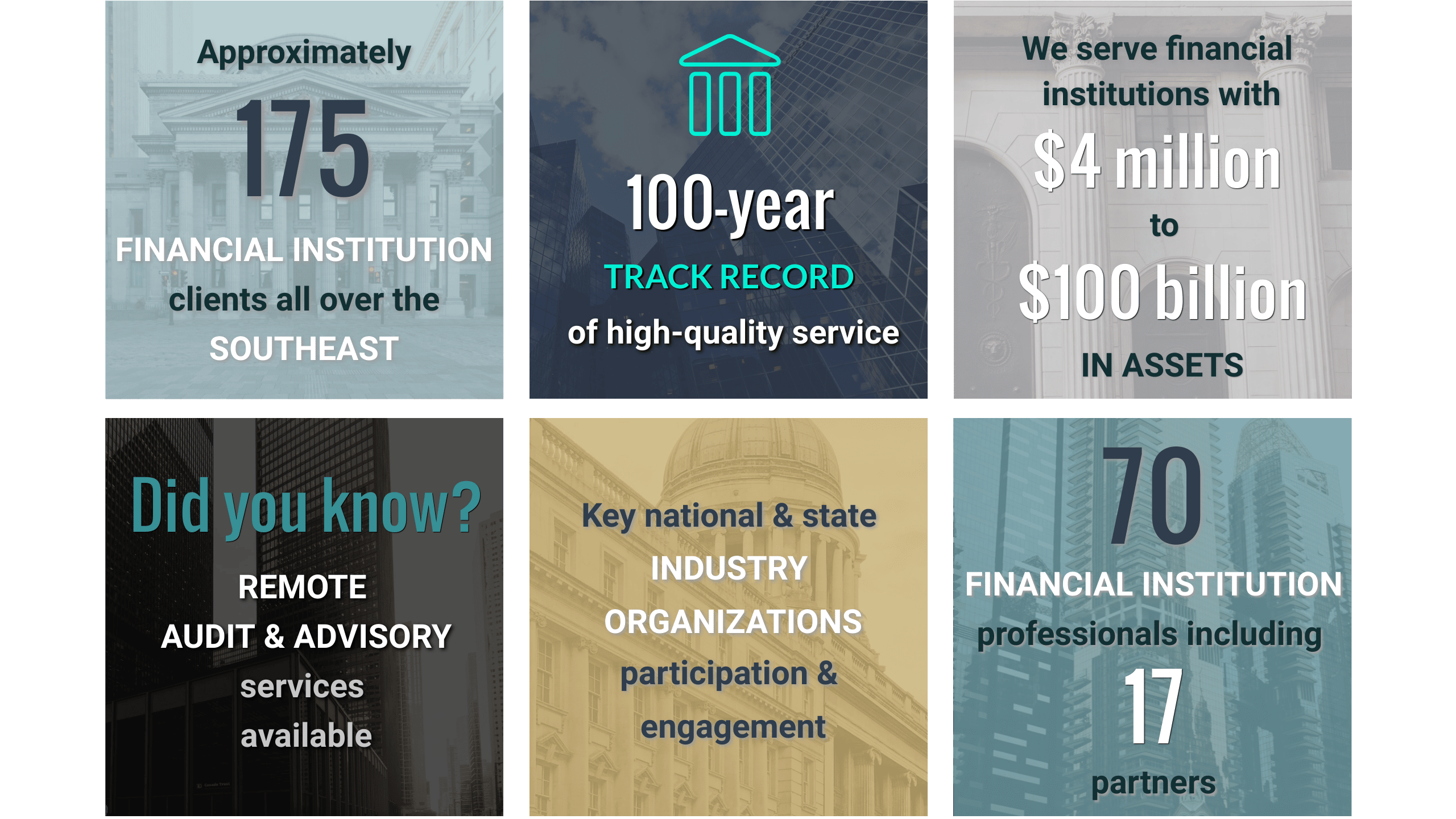

Quality assurance, tax, and advisory services are critical for financial institutions in today’s rapidly changing industry landscape. We

currently provide professional services to hundreds of financial institution clients throughout the country, which translates into a first-hand understanding of the industry and its best practices.

Assurance Services

OPINION AUDIT SERVICES

Mauldin & Jenkins is committed to compliance with all audit requirements and accounting standards, and we emphasize providing value-added audit services for our clients. We enhance the value of the audit by maintaining an open line of communication with management, the Board, and the Audit Committee for key accounting and auditing issues. Our service not only fulfills compliance with all audit and accounting standards but also strengthens our clients’ corporate governance and financial reporting. We are also a registered firm with the PCAOB and licensed to practice before the SEC on public company audit engagements. Our goal is to build lasting relationships by providing the highest quality service. Our assurance services are enhanced and further help differentiates us from other assurance service providers by:

It's important to have an audit done by a professional that is independent of the organization. This allows for a fair and truthful audit to be performed.

Depending on the number of employees, certain financial institutions are required to have their employee benefit plans, including 401K’s, audited. We provide annual employee benefit plan audits by individuals who specialize in these type audits which allows us to not only perform an audit that complies with all related accounting and reporting requirements, but to also perform the audit in a very effective and efficient manner in order to minimize disruption.

Learn more about employee benefit plan/401K audits.

Your clients need assurance that the private and sensitive data they entrust to you is secure. At Mauldin & Jenkins, our team of experts is dedicated to providing a comprehensive and extensive report of your system and organization controls.

Learn more about SOC reports.

Other assurance services we provide

Because your financial institution is not required to have an annual audit of their financial statements, a director’s exam allows you the ability to figure out what procedures you need to perform. This ensures you are getting the most out of your audit and gives you the ability to address and improve your procedures.

We are also able to perform Regulation AB audits in a timely manner. Contact your Mauldin & Jenkins professional for more information.

TAX Services

TAX PLANNING AND RETURN PREPARATION

Our financial institution tax partners assist our clients in understanding the tax challenges within the financial institutions industry, implementing tax-planning strategies to minimize tax exposure, while also avoiding non-compliance penalties and making informed business decisions concerning both federal and state tax-related matters.

More information on tax planning and return preparation.

Property Tax Compliance & Returns

Property tax can create an unnecessary financial drain on a business, limiting profitability and exposing your company to excess risk. Mauldin & Jenkins tax team helps you save money by avoiding overpayment of property taxes and ensuring complete, timely compliance with all applicable tax authorities.

Are you paying too much in property tax for inventory and materials, business personal property, business-owned real property or commercial properties? Many businesses aren’t even aware that they are overpaying because of inaccurate valuations or duplicate assessments on a single asset. They may even be paying taxes each year on real property that should be exempt from taxation.

Is this happening to your business? Maybe. Would you know how to stop the problem if it was? Probably not, because property tax laws are complex, confusing and rapidly evolving in many jurisdictions. But confusing or not, compliance is essential as the penalties for late, incomplete or inaccurate property tax returns can pose a serious financial threat to your business.

Don’t let an excessive tax burden or penalties and interest limit your company’s profitability. You don’t have to neglect your business to take a deep dive into property tax law — just turn to the tax professionals at Mauldin & Jenkins. Whether it’s identifying tax savings opportunities or keeping you in compliance without diverting your attention from urgent business priorities, we offer the comprehensive expertise and services you need to effectively manage property taxes:

- Establishing fair market value based on current market data and property review

- Evaluating annual assessments for accuracy and savings opportunities

- Filing appeals and representing your interests before local tax boards

- Forecasting tax liabilities prior to expansion, development or purchase of new properties

- Identifying tax-exempt and non-taxable properties and assets

- Integrated review of business assets for federal, state and local property valuations

- Monitoring changes to state, county and local tax policy that can affect your business

- Pursuing reassessments, exemptions and savings opportunities with tax authorities

- Reviewing accounting and records to identify issues that can lead to excess taxation

other tax Services we provide

The increasing amount of economic nexus regimes that enact statutes specifically targeting financial institutions is often overlooked. For financial institutions that have loans or credit to customers in multiple states, they need to be able to analyze the various state-specific nexus requirements. These financial institutions may be subject to filings for income tax, franchise tax, or both, and may be required to utilize specialized apportionment factors.

Learn more about how our Specialty Tax practice can help you.

Converting your C Corporation or Limited Liability Company (LLC) to an S Corp can be a confusing process. Our financial institution tax partners can walk you through the process, ensuring an easy transition.

Consulting & ADVISORY Services

Risk Management Services

Today’s regulatory and corporate accountability culture demands that financial institutions establish and maintain an effective enterprise-risk-management system. This system requires effective internal controls, ongoing monitoring, and independent testing for compliance. Outsourcing can be an effective way to meet these demands and we provide the following to assist in meeting these demands:

Our regional experience means we have the knowledge to advise our clients on the most up-to-date industry practices.

Learn more about our risk management consulting.

The regulatory compliance environment continues to expand in complexity, and our professionals can assist in answering questions on compliance matters that are most vital to every institution. We provide compliance services consulting and compliance training, as well as full-scope compliance assessments and reviews, including consumer loan and deposit compliance, Bank Secrecy Act and Anti-Money Laundering, fair lending, AML validations, and FACT Act.

Cybersecurity is a significant concern for all financial institutions. We provide information technology system consulting, as well as full-scope information technology assessments and reviews, including GLBA, penetration testing, vulnerability assessments, firewall configuration, social engineering, ADA website accessibility, NACHA, and SOC reviews.

Article One, Subsection 1.2.2 (Audits of Rules Compliance) of the NACHA Operating Rules requires all Participating Depository Financial Institutions to conduct, or have conducted, an audit of its compliance with the NACHA Rules. This requirement relates solely to compliance with the NACHA Rules and is not limited to compliance with any specific rules or group of rules. This audit obligation does not address other audit considerations with regard to a financial institution's ACH policies, procedures, or regulatory compliance. An annual audit must be conducted under the Rules Compliance Audit Requirements no later than December 31 of each year.

An audit of compliance with the NACHA Rules must be performed under the direction of the audit committee, audit manager, senior-level officer, or independent (external) examiner or auditor of the participating institution. A participating institution must retain proof that it has completed an audit of compliance in accordance with the NACHA rules, and documentation supporting the completion of the audit must be retained for a period of six years from the date of the audit.

Upon receipt of the National Association's request, a participating institution must provide to the National Association, within ten (10) Banking Days, proof that the participating institution has completed audits of compliance in accordance with the NACHA Operating Rules. Failure to provide proof of completion of its own audit, or its Third-Party Service Provider's and/or Third-Party Sender's audit, according to procedures determined by the National Association, may be considered a Class 2 rule violation pursuant to Appendix Nine, Subpart 9.4.7.4 (Class 2 Rules Violation).

Contact one of our NACHA Operating Rules and Guidelines Specialists to discuss outsourcing your next NACHA Audit of Rules Compliance.

Enterprise Risk Management aligns internal audit processes with management’s strategic plan to create an institution’s risk assessment. The Risk Assessment evaluates financial, compliance, strategic, operational, reputational, regulatory, and other risks to guide the development of an internal audit plan and, ultimately, the creation of internal audit programs for any entity. Our Risk Assessment process seeks to develop a deep understanding of your institution’s specific products, services, and risks to truly understand your institution and create a customized risk assessment.

Our internal audit approach is proactive, strategically helping your institution mitigate risk. From roles to the review process, you want everything your organization does to be both effective and efficient. By developing a deep understanding of an institution’s challenges, operations, and internal controls, we maximize efficiency, minimize disruptions, and deliver valuable recommendations. Our internal audit approach goes beyond meeting the necessary requirements and standards.

Identifying and assessing credit risk is one of the most important functions within a financial institution. Our professionals provide a full suite of loan review services, including a review of credit administration controls. We work with management, or those charged with governance, to determine a portfolio coverage ratio sufficient for your institution’s risk profile.

We can review the calculation of the allowance for loan and lease losses and perform methodology review services to check the mechanical process of calculating the allowance and to ensure compliance with current accounting standards and regulations.

An effective interest rate risk management program can assist an institution in decision making now and in the future. The regulatory agencies require institutions to have a review of their interest rate risk management process. Our Interest Rate Risk Review services are performed in accordance with guidance contained in the Joint Interagency Policy Statement on Interest Rate Risk. Our professionals evaluate the effectiveness of your interest rate risk management process and verify adequate monitoring is being performed by management and those charged with governance. Liquidity risk management, contingency funding, and cash flow stress testing can also be incorporated into the reviews.

other ADVISORY Services we provide

Our professionals have assisted in multiple M&A deals for credit due diligence to potential asset valuations over the past several years and have assisted on both the buy and sell-side. Our experienced team has assisted our financial institutions throughout the Southeast

Our professionals specialize in pre and post acquisitions needs:

- Credit due diligence

- Reviewing loan samples, applied loan pools, and other controls that support the lending functions and portfolio quality

- Other real estate owned reviews

- Assisting with and final reports of credit due diligence

- Post-transaction services

- Day 2 purchase accounting

We provide call report preparation assistance, including complete outsourcing of the entire report preparation process, if desired.

We provide fraud reviews including documenting how the fraud occurred, what changes are recommended to help reduce the likelihood of the fraud occurring again, as well as obtaining the required documentation to be provided to the bonding company or regulatory authorities.

We provide a range of COSO 2013 and SOX 404 services, including identifying and documenting key controls, mapping key controls to the control matrix, documenting process narratives, identifying and documenting supporting controls, as well as the outsourcing of certain pieces up to the entire ongoing annual internal control monitoring and related testing process.

We provide transition assistance related to the new CECL allowance methodology, including how a financial institution can use its current loan loss model for CECL, with certain modifications in order to comply with CECL’s new requirements.

We provide investment policy reviews, as well as testing for compliance with the stated policy and current regulatory requirements.

Our team of professionals is knowledgeable in the area of de novo formations, as well as the process of starting a de novo bank.

what sets us apart

Partner Accessibility

Direct partner involvement in the field to supervise qualified staff and consult with management during the audit process is just one of the benefits of working with Mauldin & Jenkins. We value our clients and their ability to access our partners.

AUDIT EFFICIENCY

Over 40 hours of annual internal training sessions designed specifically for the financial institution team to ensure that the individuals who work on your audit are experts, and as a result, are efficient and effective in order to minimize disruption to client personnel.

technology EFFICIENCY

At Mauldin & Jenkins, we utilize technology to increase our efficiency. We value our clients and their time, and our use of technology allows greater efficiency while in the office and the field.

Insights

Click the button below to access more of our Financial Institution Insights

Going Further

Our focus will always be on you and your needs. Working with more than 175 financial institutions throughout the Southeast guarantees you a team of qualified professionals. We have “large firm” resources with a “local firm” client service approach. We have become recognized experts one satisfied client at a time. Let us be your trusted advisor to help you achieve your goals.