As your company expands, grows or relocates, Mauldin & Jenkins’ experienced Specialty Tax professionals possess the knowledge and skills needed to navigate complicated multi-state tax laws, allowing you to focus on the business at hand. Our CPAs work collaboratively with businesses to uncover and address state and local tax issues. Whether you have been selected for a tax audit or are eager to be proactive in your tax planning, our experienced professionals can help.

our specialty tax services include:

Employee Retention Credit

The Employee Retention Credit (ERC) was created during the coronavirus pandemic to encourage businesses to keep their employees. Learn more...

PROPERTY TAX COMPLIANCE & RETURNS

Property tax can create an unnecessary financial drain on a business, limiting profitability and exposing your company to excess risk. M&J's tax team helps you save money by avoiding overpayment of property taxes and ensuring complete, timely compliance with all applicable tax authorities.

Are you paying too much in property tax for inventory and materials, business personal property, business-owned real property or commercial properties? Many businesses aren’t even aware that they are overpaying because of inaccurate valuations or duplicate assessments on a single asset. They may even be paying taxes each year on real property that should be exempt from taxation.

Is this happening to your business? Maybe. Would you know how to stop the problem if it was? Probably not, because property tax laws are complex, confusing and rapidly evolving in many jurisdictions. But confusing or not, compliance is essential as the penalties for late, incomplete or inaccurate property tax returns can pose a serious financial threat to your business.

Don’t let an excessive tax burden or penalties and interest limit your company’s profitability. You don’t have to neglect your business to take a deep dive into property tax law — just turn to the tax professionals at Mauldin & Jenkins. Whether it’s identifying tax savings opportunities or keeping you in compliance without diverting your attention from urgent business priorities, we offer the comprehensive expertise and services you need to effectively manage property taxes:

- Establishing fair market value based on current market data and property review

- Evaluating annual assessments for accuracy and savings opportunities

- Filing appeals and representing your interests before local tax boards

- Forecasting tax liabilities prior to expansion, development or purchase of new properties

- Identifying tax-exempt and non-taxable properties and assets

- Integrated review of business assets for federal, state and local property valuations

- Monitoring changes to state, county and local tax policy that can affect your business

- Pursuing reassessments, exemptions and savings opportunities with tax authorities

- Reviewing accounting and records to identify issues that can lead to excess taxation

Outsourced Tax Return Preparation and Filing

Using calculation information by jurisdiction to complete, file, and pay a return in required jurisdictions.

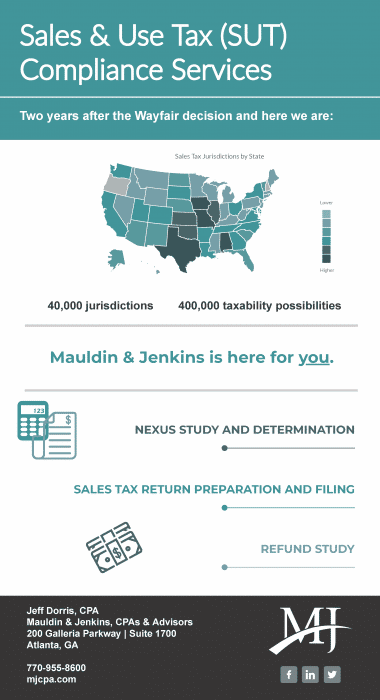

Comprehensive Nexus Study

Analysis of operations, sales, and purchases to determine what tax obligations exist by jurisdiction. The study includes income, franchise, and sales and use tax.

Product Taxability Review

Review of products sold or purchased to determine taxability by jurisdiction.

Voluntary Disclosure Agreement (VDA)

Assistance in participation in state Voluntary Disclosure Agreement programs to disclose unpaid/underpaid liabilities.

Sales and Use Tax calculations at the time of transaction (software calculation)

Ongoing Sales and Use Tax advisory and review services

Gathering exemption certificates and monitoring expiration dates, renewing as needed

Registering the business as a seller in state or local jurisdictions, typically resulting in an assignment of a registration number

An in-depth audit of accounts receivable, accounts payable, and fixed assets (internal audit of what you are buying and selling as well as the process)

Examination of an audit done by a state auditor to indicate agreement or disagreement, which may find overpayment of sales tax in the actual audit

Reviewing accounts payable to identify overpaid sales tax and filing refund requests/returns

Managing a client’s audit from start to finish so the client does not have to interact with the auditor

Facilitation of a simulated state audit to determine potential exposure

There are a number of complex tax compliance requirements that multi-state companies face. It is important to understand and comply with these rules in order to avoid costly SALT assessments down the road. To learn more about the proactive steps you can take, contact us.

WHAT OUR CLIENTS ARE SAYING

"The services provided by Mauldin & Jenkins have been excellent. Specifically, Jeff Dorris helped us successfully navigate through a significant sales tax project. He took the time to fully understand our needs and provided straight-forward guidance. Jeff is very knowledgeable, thorough and truly a pleasure to work with, and I recommend him without reservation."

"Jeff Dorris and the entire M&J team have been extremely helpful in getting Sunnyland Farms compliant with new sales tax requirements following the Wayfair decision. They have taken the time to not only understand the complexities of our business but also help us code all of our products correctly for all state and local tax jurisdictions. Trying to do these tasks without their assistance and guidance would have been virtually impossible. I would highly recommend engaging Jeff and his team to assist with any sales tax issues."

Consulting & Advisory Professionals

REQUEST A CONSULTATION

How can we help you achieve your goals? Please enter your details below, and one of our team members will contact you soon.