TaxCaddy

TaxCaddy makes gathering tax documents and sharing them

with your tax professional a breeze. Let TaxCaddy retrieve your

1099s, 1098s and W-2s automatically. Upload or snap photos

of your tax documents year-round and store them with bank

vault security. Electronically sign your tax documents from

anywhere. No more office visits. No more paper organizers.

Your tax professional’s work is complicated.

Your part should not be. Simplify tax time.

Thank you for creating your TaxCaddy account last year. To ensure you’re ready to go this year, see the following tips and instructions.

LOG IN TO YOUR ACCOUNT

Please click HERE for instructions on how to log in to your TaxCaddy account.

NEED SUPPORT?

If you have technical questions about your TaxCaddy account or you’re experiencing trouble accessing your account, the TaxCaddy support team is ready to assist. For more information about getting help, visit the TaxCaddy Help Center.

ADD AUTHORIZED USERS

To provide access to your spouse or others, click your name in the top right corner and then Settings. Click 'Additional User Account' and enter their information. They will receive an invitation to create a linked account with the same steps you have already completed. For more information, see the sharing account access instructions.

SET UP “SMART LINKS”

Take advantage of TaxCaddy’s ability to automatically download tax documents from your banks and other financial institutions by setting up Smart Links. As documents such as your 1099 are posted, they will be automatically retrieved and placed in your TaxCaddy account. For more information, visit the page for smart links.

MOBILE APP OPTION

TaxCaddy’s mobile app provides a convenient way to access your information and communicate with us directly from your mobile phone. You can even photo-scan paper documents and upload them to your TaxCaddy account. Download the app from the iTunes App Store or on Google Play. Learn more about the mobile app.

PROVIDE YOUR TAX INFORMATION

Upload your tax documents as you receive them. If you have any questions throughout the process, please contact your tax advisor.

TaxCaddy makes it easier than ever to gather your tax documents and deliver them to us electronically. We are excited to offer you this easy-to-use solution.

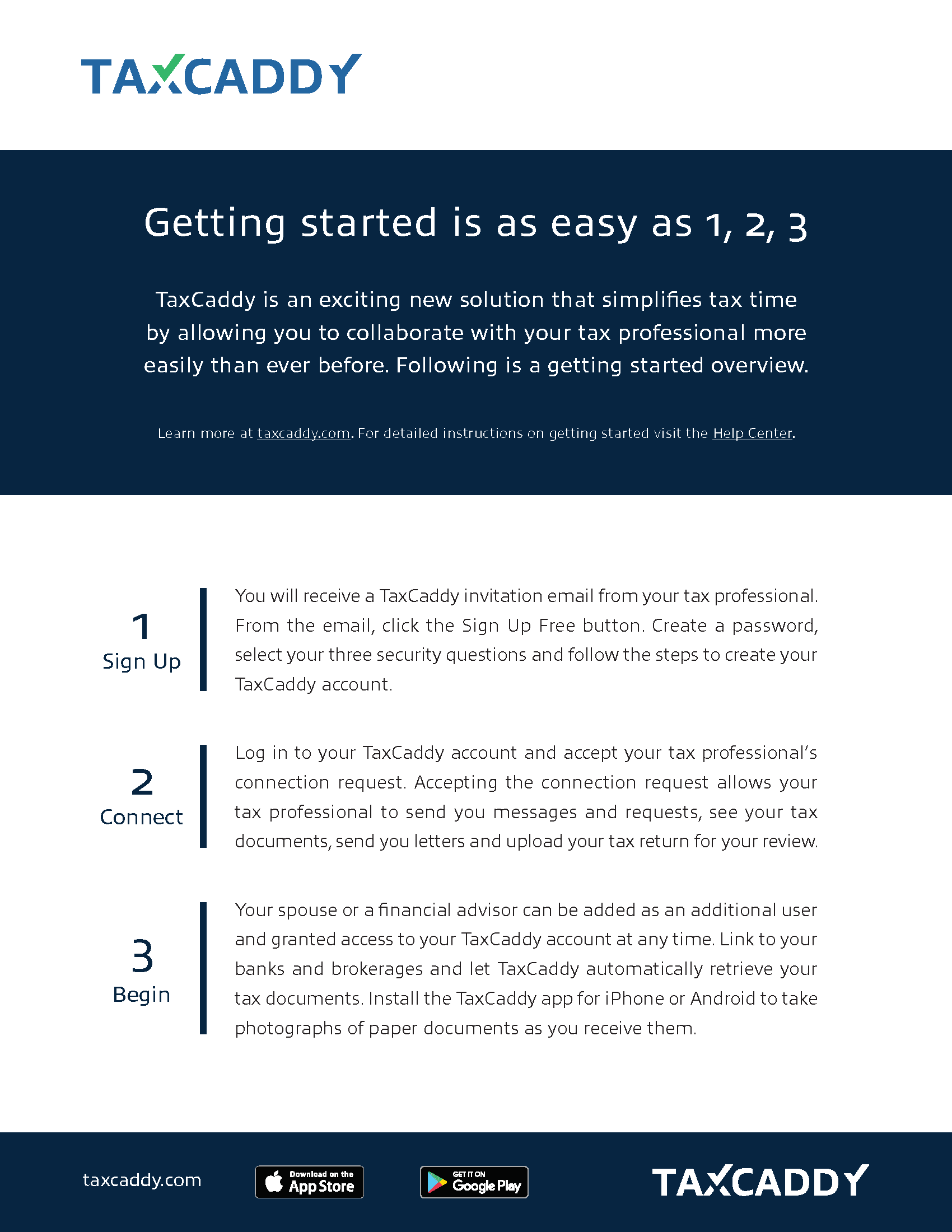

1. You will receive a TaxCaddy invitation email from your tax professional. From the email, click the Sign Up Free button. Create a password, select your three security questions, and follow the steps to create your TaxCaddy account.

2. Log in to your TaxCaddy account and accept your tax professional’s connection request. Accepting the connection request allows your tax professional to send you messages and requests, see your tax documents, send you letters and upload your tax return for your review.

3. Your spouse or a financial advisor can be added as an additional user and given granted access to your TaxCaddy account at any time. Link to your banks and brokerages and let TaxCaddy automatically retrieve your tax documents. Install the TaxCaddy app for iPhone or Android to take photographs of paper documents as you receive them.

Tax Time Simplified

TaxCaddy makes gathering tax documents and sharing them with your tax professional a breeze Click HERE to learn more.

Getting started is as easy as 1, 2, 3

TaxCaddy is an exciting new solution that simplifies tax time by allowing you to collaborate with your tax professional more easily than ever before. Click HERE to learn how to get started.

5 Tips to Simplify Tax Time

April 15 always seems to sneak up, and surely this year will be no different. While there’s no escaping the tax deadline, this year will be the easiest tax season ever. Use the following tips to streamline the tax return process and minimize stress.

Review and complete the tax organizer. The organizer provides you with your prior year information and helps your tax professional gather valuable information about you that may impact your tax return.

Provide electronic documents whenever possible. The electronic tax documents obtained directly from your banks and brokerages are high quality and easy to read, which minimizes errors.

Respond to communications from your tax professional as quickly as possible. Often our questions just require a short answer to finalize the preparation of your tax return.

Review your prepared tax return as soon as it’s available so that any necessary corrections can be made well before the April 15 filing deadline. If no corrections are needed, sign the e-file authorization to complete the process.

The four tips outlined above are suggestions we’ve made for years. They help streamline the process for you and your tax professional. With your help, we can focus on maximizing valuable tax deductions. The fifth tip is new this year, and it makes the first four tips a breeze.

- Sign up for your free TaxCaddy account.

TaxCaddy makes it easier than ever to gather your 1040 tax documents and deliver them to us, communicate with us, answer your questionnaire electronically, and sign documents like the e-file authorization. We’re excited about this powerful, free solution and we think you will be, too.

Soon you’ll receive an email inviting you to create your TaxCaddy account. Once you receive the invitation there are three easy steps to get started. See attached for an overview. <<attach the TaxCaddy Taxpayer Overview PDF>>

So be on the lookout for the TaxCaddy invitation email. In the meantime, if you’d like to learn more about TaxCaddy visit the website below.

Learn more at: https://taxcaddy.com/ (Note: Don’t use the “Sign Up Free” option on the TaxCaddy website. You’ll use a link we’ll include in our upcoming invitation.)