The Government Finance Officers Association (GFOA) has recently notified Certificate of Achievement for Excellence in Financial Reporting (COA) program participants of a change to the program submission criteria. Beginning March 1, 2022, applications submitted to the COA program will be required to be accompanied by a file (PDF or Excel) containing the calculation of the net investment in capital assets reported on government-wide statements of net position for both governmental and business-type activities, as applicable. These submissions should include the calculations for governmental activities, business-type activities, major enterprise funds, stand-alone business type activities, and discretely presented component units each year.

Why the new requirement? The calculation of the net investment in capital assets is an area where the GFOA certificate program reviewers have noticed significant errors. This requires the COA reviewer to contact the applicant in order to obtain support for their calculation(s), which in turn has been causing significant delays in processing the COA applications. It is the GFOA’s hope that by requiring this additional submission in advance, the process will be expedited for the applicants and the COA reviewers.

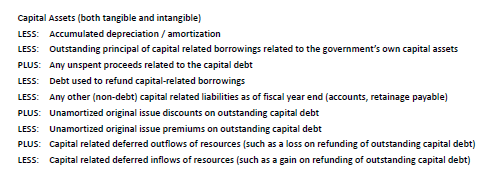

How is the net investment in capital assets calculated? Governmental Accounting Standards Board (GASB) Codification Section 2200.118 as well as Chapter 19 of the Governmental Accounting, Auditing, and Financial Reporting (GAAFR or the “Blue Book”) prescribes the required calculation, which includes the following elements:

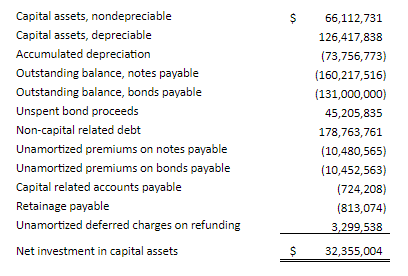

An example calculation:

Some notes to consider:

- 1. The accounts payable and retainage payable included in the calculation are related to capital assets. Governments need to make sure to identify these balances as they may not be evident from the face of the financial statements. In the end, the balances being included in the calculation need to be related to capital assets.

- 2. In the above calculation, the government has added back $178.8 million of “non-capital related debt.” In some instances, governments may issue debt that is not for capital assets of the issuing entity (for example, a county government issuing debt on behalf of the county school system). When that occurs, that debt needs to be added back because it is not considered capital-related debt of the reporting government.

- Along with GASB Statement No. 63, GASB Implementation Guide 2015-1 provides additional guidance on the calculation of the net investment in capital assets. If you have any questions, please reach out to our Mauldin & Jenkins professionals. We are happy to help!