[…]

Dear Clients and Friends,

As events continue to unfold surrounding COVID-19, we have made the decision to implement a remote work plan effective today, March 23, 2020. Our office locations will be closed in the interim. We are doing this to safeguard our people, their families, and our community as well as yours. Mauldin & Jenkins recognizes that you are depending on us, and we are committed to providing the highest level of service. Our technology allows us to remotely handle all client requests, calls, and ongoing audit, tax and advisory work in a seamless manner.

Mauldin & Jenkins is continuously evaluating guidance from the CDC and other health professionals. While we are not sure of the duration of our remote work plan, we will communicate updates to you in a timely manner.

To view additional announcements and information regarding COVID-19 provided by M&J, please visit our COVID-19 impact page.

stimulus consulting

During these unprecedented times, you need advisors you can trust. At Mauldin & Jenkins, we will use our knowledge and expertise to help guide you, as a business owner or organization, to fully interpret all stimulus loan programs, including the Cares Act and Paycheck Protection Program. Please click HERE if you would like to learn more about how we can assist you.

state executive orders

If you would like more information on the Executive Orders concerning COVID-19, please click here.

Agencies Issue Guidance on Working with Borrowers Nearing End of COVID-19 Accommodations

For more information regarding guidance, please click HERE.

Please visit ABA's website for more information.

OCC Warns of Compliance Risk as Banks Adapt to COVID-19 Changes

If you would like more information on Compliance Risk due to COVID-19, or if you would like to read the Semiannual Risk Perspective, please click the images below.

webinar: New COVID 19 Stimulus Package, Including PPP Round Two and New Tax Provisions

Join Mauldin & Jenkins for the latest update on the new $900 billion COVID-19 stimulus package, including updates to the Paycheck Protection Program (PPP) and forgiveness program along with new tax provisions, that was passed on December 27, 2020. While guidance is still being provided, our experts will walk you through the new implications of the stimulus package that will provide much needed COVID-19 related relief to families and businesses.

Click here to view the webinar, or click the image.

Click here to view the slides.

webinar: paycheck protection program loan forgiveness process

webinar: paycheck protection program loan and forgiveness update

The new Paycheck Protection Program Flexibility Act of 2020, which loosens several of the Paycheck Protection Program’s (PPP’s) more onerous restrictions regarding loan forgiveness, was passed into law on June 5, 2020. The new law follows the May 22, 2020, release of an interim final rule from the U.S. Department of Treasury and the Small Business Administration (SBA) on PPP loan forgiveness requirements. Among other areas, that guidance addresses the calculation of full-time employees and total salary or wages for purposes of loan forgiveness reductions.

Click here to view the webinar, or click the image.

Click here to view the slides.

webinar: Impact of COVID 19 and the CARES Act on your retirement plan

Join Mauldin & Jenkins, LLC, Sarasota Private Trust Company and Bass, Berry & Sims, PLC, for a webinar on the Impact of COVID-19 and the CARES Act on retirement plans and what plan sponsors should know. This webinar will help you navigate rule changes for retirement plans to help plan sponsors understand the administrative impact of the new laws. To better understand the impact to your plans, please view the webinar by clicking the image.

Please click here to access the slides.

Please click here to view the webinar.

webinar: navigating financial relief from COVid-19

Join The ATL Airport Chamber for a webinar on the impact of COVID-19 and the relief available to Nonprofits with speakers from Mauldin & Jenkins, LLC. This webinar will help you navigate the federal stimulus CARES Act application process as well as other resources that will help you and your nonprofit through this time. To better understand the loan program and how it can help your nonprofit

Please click here to access the slides.

Please click here to view the webinar, or click the image.

webinar: navigating covid-19 for nonprofits

Join Mauldin & Jenkins, LLC for a webinar on the Impact of COVID-19 and the relief available to Nonprofits. This webinar will help you navigate the federal stimulus CARES Act application process as well as other resources that will help you and your nonprofit through this unprecedented time. To better understand the loan program and how it can help your nonprofit.

Unfortunately, we had a few technical challenges during our webinar. If you would like to view the presentation again, please click here to access the slides.

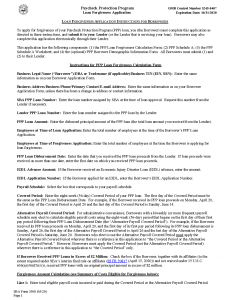

webinar: Paycheck protection program

Join Mauldin & Jenkins, LLC and Fenimore, Kay, Harrison, & Ford, LLP for a webinar on the Paycheck Protection Program (PPP). On Friday, March 27th, President Trump signed into law the CARES Act. This bill provides significant relief for small businesses, including $349 billion in Small Business Administration (SBA) loan guarantees and subsidies. This new loan program can provide up to $10 million of funding, which may be forgiven if certain criteria are met. We are encouraging all of our clients that qualify to evaluate this relief program.

To view the webinar please click the picture.

To view a PDF version of the slides please click HERE.

webinar: navigating employment issues and the coronavirus - what to do and not to do

tax updates

nonprofit updates

COVID-19 updates

Stay up to date on the latest information regarding the Coronavirus pandemic.

we are here to help

As we all continue to work through these unprecedented times, know that we are here as a resource to assist in navigating these unfamiliar waters.

For more information on how the coronavirus may impact you and your business, contact your Mauldin & Jenkins professional by clicking the button below.